Buyer's Guide to Paying a Deposit

Deposits Made Easy

With Deposits, buyers are provided with convenient, flexible, and secure means to pay for the deposit.

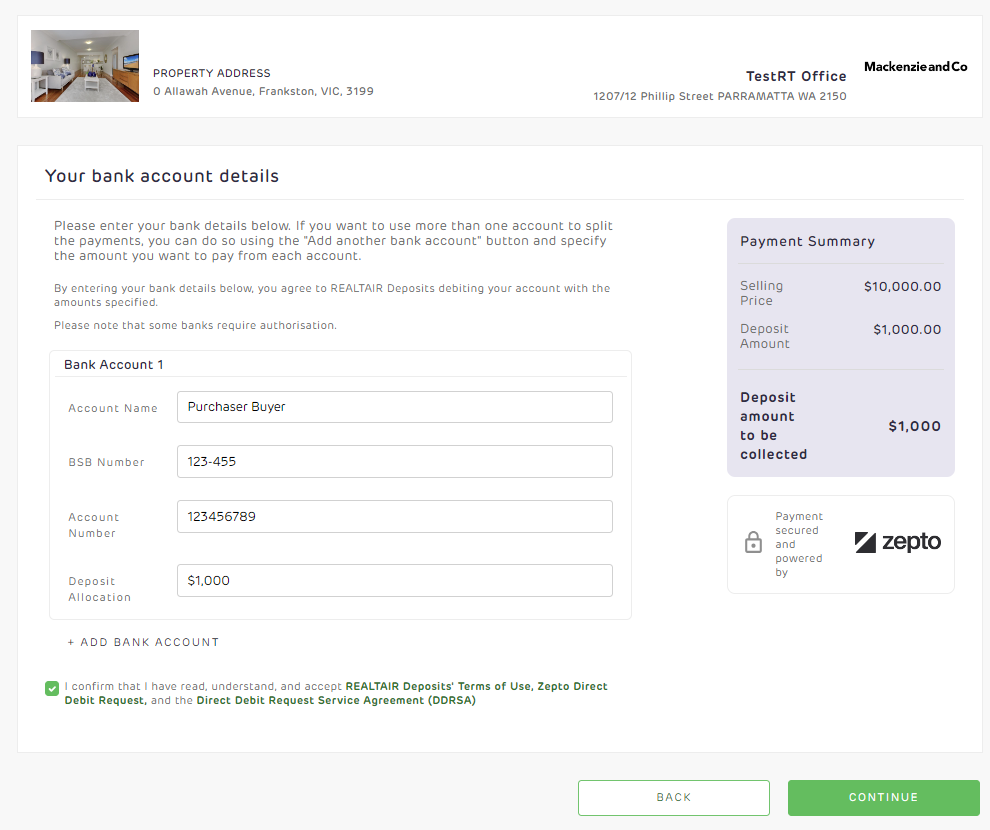

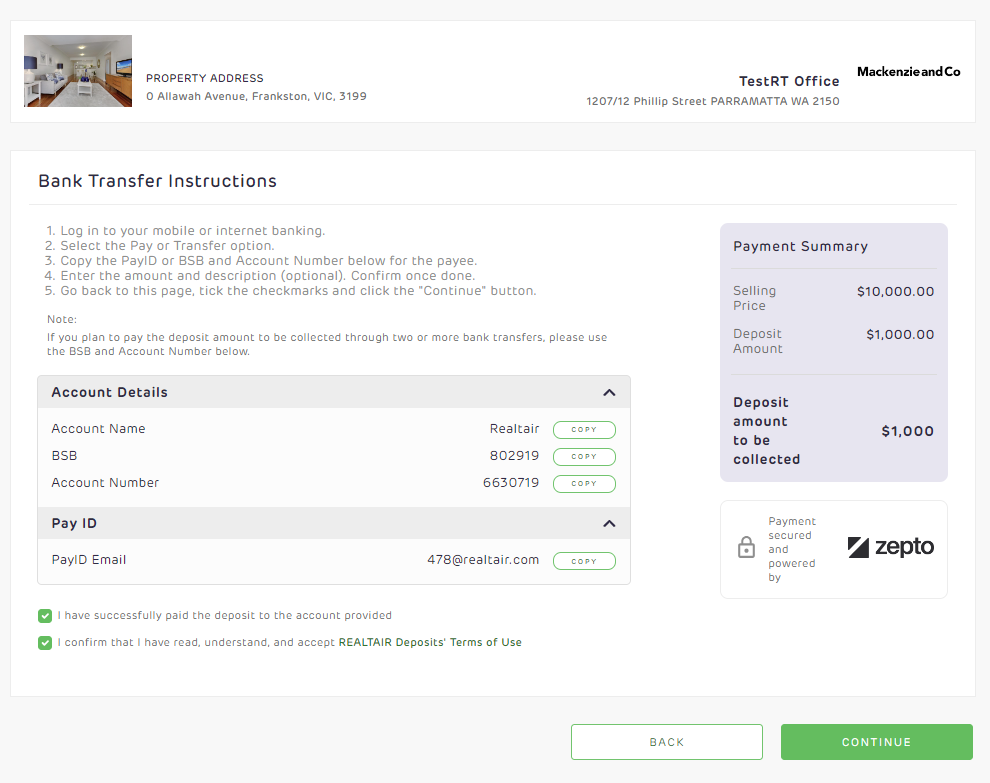

Deposit payment can be done upfront or remotely. We have options for direct debit and bank transfer payments. With direct debit, you will only need to provide the bank details from where the deposit will be deducted. Alternatively, you may choose to transfer the funds to a designated BSB and Account number.

To ensure payments will go through without any problem, it is best to make arrangements or discuss with your bank partner the limits imposed on your account.

Reminders for Deposit Payment

-

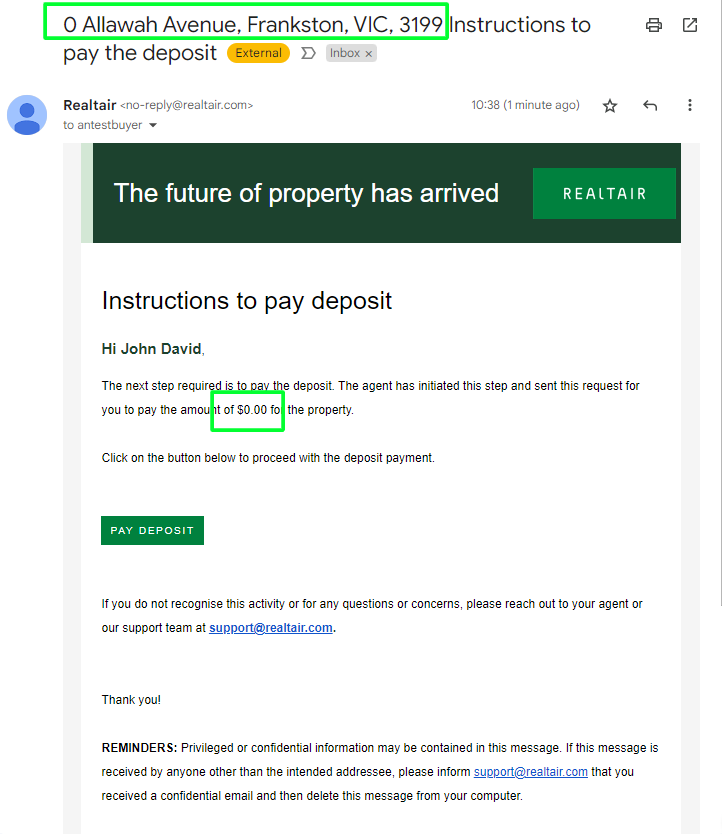

You will receive an email notification from the Agent’s email containing the secured payment link. Make sure that it is sent from the Agent’s email via Deposits to avoid phishing and other suspicious activities.

-

Ensure to review the payment details including the address and deposit amount before proceeding with payment. If there is any information that needs to be updated, please reach out to your agent.

-

For Direct debit payments, you can add as many as four bank accounts. The Total Deposit allocation should always be equal to the Pending amount.

-

For Bank transfer payments, use the Copy button to make sure the correct BSB and Account number are used for the transfer. Payments may be split into several transactions.

-

Once the payment has been initiated and once it has been received on the trust account, notifications will be sent out.

-

Direct debit and Bank transfer payments generally take 1 to 2 business days to clear in the trust account. In Direct debit, it may take longer if the payments were made past 7:15 pm or if there are holidays.

-

If the deposit payment fails, you will be notified via email and SMS. Note that we only have visibility on the failure reasons that the banks have passed on to us.

-

Transaction statuses, limits, and failure reasons may differ from bank to bank. For any questions or clarifications, it is best to reach out to your bank partner.

![Realtair RGB Green Box Logo.jpg]](https://help.realtair.com/hs-fs/hubfs/Realtair%20RGB%20Green%20Box%20Logo.jpg?height=50&name=Realtair%20RGB%20Green%20Box%20Logo.jpg)